As we approach 2025, the economic and housing market indicators point towards a more balanced and optimistic landscape. Drawing insights from policy rates, bond yields, and market trends, here's an overview of what to expect in the year ahead.

Mortgage Rates: Stabilizing Around the "New Normal"

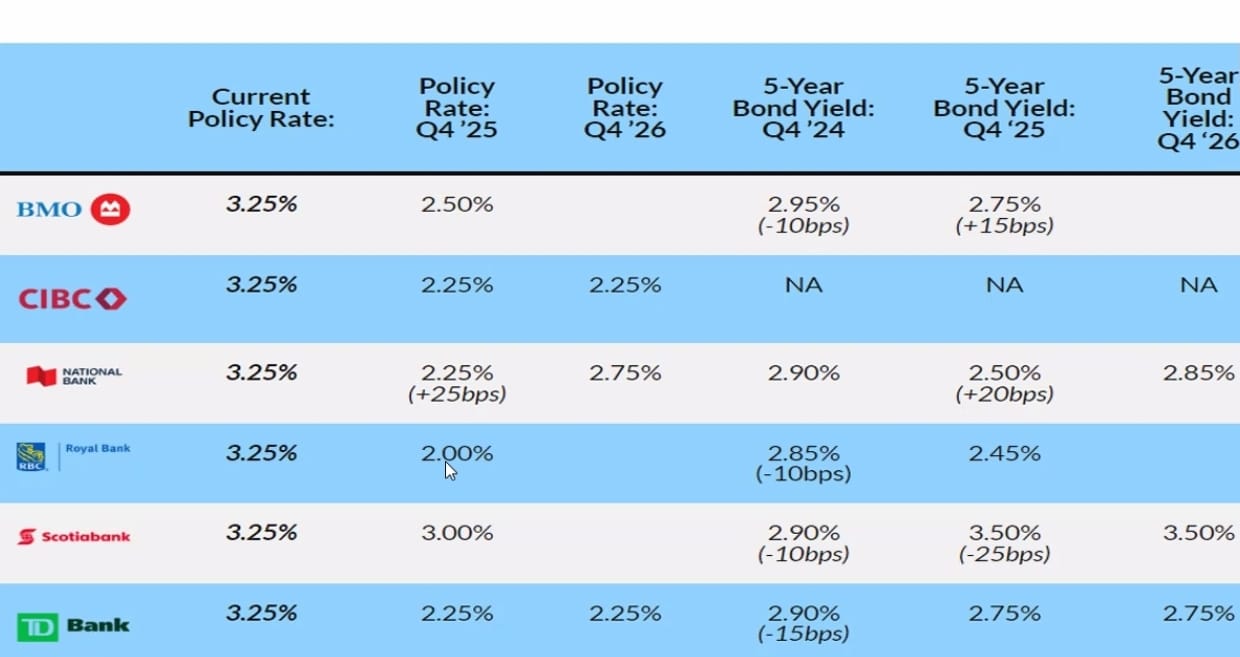

Mortgage rates in 2025 are expected to decline slightly but stabilize around the 3% mark. This aligns with the new post-pandemic normal, as the era of ultra-low rates (1-2%) seems unlikely to return. Data from major financial institutions, such as RBC and BMO, reflect a trend of lower policy rates for Q4 2025, ranging between 2.00% to 2.50%. This downward shift in borrowing costs will positively influence affordability, providing potential buyers with an opportunity to enter the market.

The 5-year bond yields also show a gradual recovery, with most institutions projecting a steady trajectory. For instance, bond yields for Q4 2025 are expected to hover around 2.50%–2.75%, fostering a favorable lending environment.

Home Sales: A Promising Rebound

Following a historically low sales period in 2023, 2025 is poised for a recovery in home sales, with projections indicating a 10% increase. This rebound is supported by declining mortgage rates and stronger economic conditions. Increased buyer confidence, combined with improved affordability, is likely to stimulate transaction volumes.

Housing Supply: Easing Affordability Pressures

Inventory levels are expected to grow as home construction accelerates. Government policies aimed at deregulation and development are likely to play a pivotal role in addressing housing shortages. While affordability will remain a challenge, the increasing supply may help moderate price growth, making homes more accessible to a wider range of buyers.

Economic Conditions: Stability Fuels Confidence

Stable economic indicators and job growth are setting a solid foundation for the 2025 market. Fears of a recession appear to be overstated, and a robust economic outlook is expected to bolster consumer confidence. This stability will likely encourage both buyers and sellers to engage more actively in the market, contributing to the anticipated rise in sales.

Key Takeaways for 2025

- Mortgage Rates: Expected to stabilize at approximately 3%, improving affordability for buyers.

- Home Sales: A 10% increase in transactions is anticipated as the market rebounds from the lows of 2023.

- Housing Supply: Growing inventory levels may alleviate affordability pressures, driven by increased construction and supportive policies.

- Economic Confidence: Stable indicators and job growth will foster trust among market participants.

2025 is shaping up to be a year of cautious optimism, with the housing market striking a balance between supply and demand. Whether you're a buyer, seller, or investor, this stabilized environment offers opportunities for growth and strategic decision-making.

CONTACT NEGIN RAZAVI REAL ESTATE BROKER

VISIT WEBSITE: https://www.razavirealestate.ca/

FEATURED LISTINGS: https://www.realtor.ca/real-estate/27747380/676-fisher-street-north-grenville-801-kemptville